Housing Market Trends for March

Welcome to the Housing Market Trends for March! This report focuses on the residential real estate housing market. We listen to the experts and boil down what they have to say to assist you, our heroes, with decision making regarding buying a home, selling your home, or refinancing your mortgage.

Housing Market Trends March Key Takeaways

The housing market is ever-evolving. Economic factors, government policies, interest rates, and even socio-cultural shifts can play a role in how the market behaves. That said, here are some housing market trends for February to help determine what’s best for you as you consider your housing situation:

- Mortgage Rate Trends – Mortgage rates have fluctuated over the past six months, with recent declines presenting an opportunity for buyers to enter the market with less competition.

- Home Inventory Trends – Rising inventory levels provide buyers with more options, but many first-time homebuyers still need lower mortgage rates to afford a home.

- Home Pricing Trends – Home prices are at their seasonal low but continue to appreciate, benefiting homeowners and sellers while making affordability more challenging for buyers.

- Homebuyer Outlook – Despite rising inflation impacting household spending, a growing percentage of Americans remain optimistic about homeownership, with 15% planning to buy a home in the next year.

- Save with Homes for Heroes – The Homes for Heroes program provides significant savings to community heroes, with an average savings of $3,000 after buying, selling, or refinancing a home with our local specialists.

Mortgage Rate Trends

If you have been watching mortgage interest rates over the past 6 months, you’ve witnessed the roller coaster of ups and downs first hand.

Mortgage interest rates crept back up again in the beginning of February, but recently have begun to decline again. As of Wednesday February 26, OptimalBlue shows the 30-year conforming at 6.644% and the 15-year conforming at 5.861%. For yesterday’s mortgage interest rate indices, be sure to check out our mortgage rate calculator.

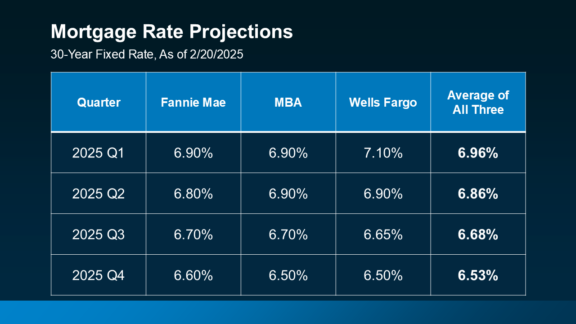

The table above shows average mortgage rate projections by quarter for 2025. In the first half of the year, industry leaders are projecting mortgage rates for the 30-year fixed to end up around 6.9%, and eventually ending the year around 6.5%. This data is as of February 20th. So rates are less likely to move much for the next few months, but now appears a good time to take advantage of the recent decline.

Some buyers have been priced out of the market, in part due to current interest rates. The advantage for a potential home buyer who can afford to enter the market with interest rates at current levels, means they will face less competition and potentially gain some buying power if the seller is receiving less interest in their home, or a lack of offers.

If interest rates do come down, which they likely will in the future, a person who purchases a home today can refinance their . This is always an option if the opportunity of a lower interest rate presents itself, and it makes sense from a financial standpoint, because there are costs associated with refinancing.

If you are thinking about getting into the housing market, remember to consider working with Homes for Heroes real estate and mortgage specialists to help you through the process. We help local heroes (firefighters, EMS, law enforcement, military and veterans, healthcare professionals, and teachers) save significant money when they close on a home with our specialists. On average, you can save $3,000 if you buy a home, and $6,000 if you buy AND sell a home.

Contact us today to help you and answer your questions! Melissa and D'Ann

Home Inventory Trends

The National Association of Realtors (NAR) reported the inventory of unsold existing homes grew 3.5% in January 2025 versus the previous month of December 2024. This is a 16.8% increase versus one year ago in January 2024.

Increased inventory is great news for buyers looking for the right home. It gives buyers more opportunity to find a home that fits their needs at a price they can afford.

Unfortunately, many first time home buyers also need mortgage rates to decrease to find an affordable home.

2025 Home Pricing Trends

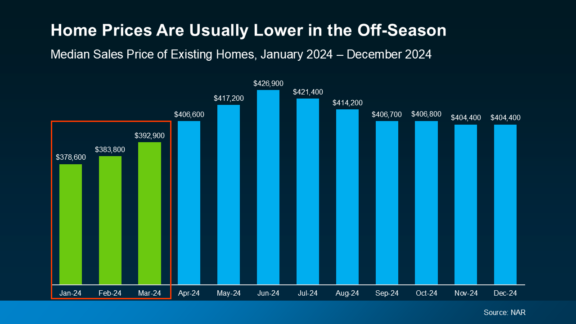

Actually during the months of January – March, home prices tend to be at their lowest point of the year. So, from a seasonality standpoint, there is still time to get into the housing market before seasonality starts to increase home prices. As you can see above, the bar graph depicts January – December 2024 monthly median home sales prices (existing homes). As you can see the median home price typically goes up due to stronger demand during the spring, summer and fall months.

The National Association of Realtors (NAR) reported that national home prices increased 4.8% in January 2025, versus YOY January 2024. And, that marks the 19th consecutive month of year-over-year national median existing home sales price gains.

This is great news for homeowners worried about loss of recent equity gains for their current home.

It’s also good news for would-be home sellers who want to capitalize on the recent home price increases to leverage that gained equity for other financial priorities.

However, this is not great news for home buyers who are still struggling to find affordable housing options in today’s market.

If you’re deciding whether to enter the market to purchase a home and would like to better understand your current local housing market trends, contact us today! Homes for Heroes

Home Buyer Outlook

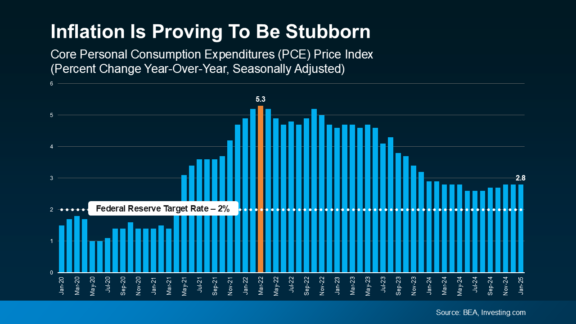

Inflation is a common topic in American homes, and it continues to be an emphasis within the media. The Fed wants it down to 2%. But, inflation has gradually increased over the past six months.

Higher inflation rates tend to negatively impact the average American household’s spending power; meaning less money available to spend on goods and services.

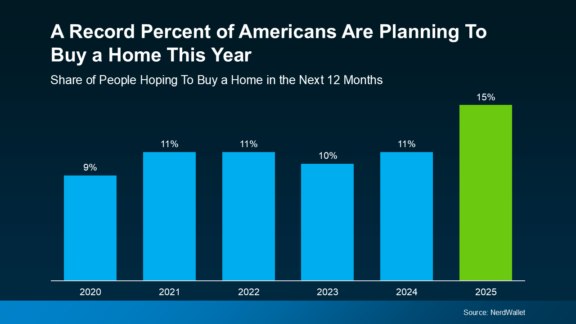

However, according to a recent survey conducted by NerdWallet, they found that 15% of the respondents are planning to purchase a new home in the next 12 months. This percentage is higher than it has been over the past five years, and shows Americans seem to be more optimistic about making a move to a new home in 2025.

Despite all of the challenges of interest rates, low inventory and home affordability, it seems Americans still understand the benefits of owning a home.

Receive an Average of $3,000 from Homes for Heroes

Homes for Heroes assists firefighters, EMS, law enforcement, active military and veterans, healthcare professionals and teachers; with buying, selling and refinancing their home or mortgage. But if you work with our local real estate and mortgage specialists to buy, sell or refinance; they also provide significant savings after you close on a home or mortgage.

We refer to these savings as Hero Rewards, and the average amount received by a hero who closes on a home with our local specialists is $3,000, or $6,000 if you buy and sell!

As local Homes For Heroes Specialists in your area we can help you navigate this market. There’s no obligation. After you sign up, we will contact you to ask a few questions and help you determine the appropriate next steps for you.

We are ready and willing to assist you through every step of the process, and save you money when it’s all done.

It is how we thank community heroes like you for your dedication and valuable service.

Melissa & D'Ann

Comments

Post a Comment